Thursday, October 12, 2017

The Biggest Waste of Money There Is

I have written many posts about items in your life that are a waste of your time and money. Things like bank fees, unused memberships, shopping addictions, and boozing it up all kill your bottom line. I could name 100 things that kill your monthly cash flow, the list is endless. Today, I am going to focus on the biggest waste of money you will ever experience. This one is something you know very well. In fact, it is something you have owned your whole adult life. The biggest waste of money that has ever existed is people themselves, and their perception of money. In this post, I will describe 3 money mentalities that will cause you to waste your time and live in relative poverty. We need to remember that even rich people may not be financially independent. They may be living paycheck to paycheck just like the guy on minimum wage, and I know, I’ve seen it. These mentalities are extremely detrimental to your life and sadly have become commonplace in our country. This has led us to live in a debt-ridden, consumerist society that has everyone in fear of what’s next. Let’s explore some terrible money mentalities.

I can always make more money (Delusion)

This one is complete and utter nonsense. Most people do not realize that there is a finite amount of money they can make. What I mean by this is that no matter how much money you make, your time to make it is finite. Yes, we can get raises and yes we can change jobs to make more money. The problem still remains that even if you made more money, what would you do with it? I believe everyone should strive to make more money, but I also believe that everyone should have a strong focus on utilizing the money they have to its fullest potential. Banking on making more money is a “paycheck to paycheck” mentality. You are always waiting for the next hit, the next big break. Sure enough, you have not broken the habits that have left you broke, to begin with. It gets even worse. What if you can’t make more money? What if the money stops? We all know someone affected by injury or illness. Even worse, what if you die? These things happen every day so no, you won’t make more money.

If you average $50,000 a year in salary from age 30-65 you will make 1.75 Million in your lifetime. If that sounds like a lot it is because it is your whole life. If you aren’t saving and handling your obligations now, what makes you think it’ll change? You have a finite amount of time and money. What are you going to do with that 1.75 million?

How to Regain (or gain) your Money Optimism – Budget Boss

Debt is normal and if you don’t have debt you aren’t living (Denial and Hypocrisy)

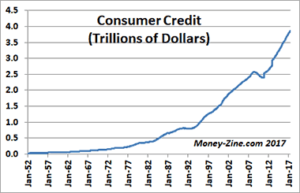

Debt is not normal. Sorry, I am wrong, let me rephrase that. Debt is normal now, but that hasn’t always been the case. Before the 1980’s consumer debt was relatively low.

In the 1950’s consumer debt was around $0 per person. Only after the 1980’s did it skyrocket. What caused this change?

Historical Consumer Debt Statistics – Money Zine

It is only as the baby boomers aged, the economy slowed, advertising became explosive, and glamorous lifestyles became over envied that debt became fashionable. Skip back one generation and debt was shameful. Fast forward to today and people have become complacent with debt. The main problem with this mentality is that it comes in direct conflict with our hatred of the 1% elite. Let me illustrate this for you:

We believe the super-rich should share their wealth with the rest of society

We buy their products (Wal-Mart, Nike, Amazon, Apple) and make them even richer

We use Debt (Credit Cards and Lines of Credit) to make them even richer (Banks)

We bitch about Tax Rules hurting the little guy, yet we shop at the Big Guy’s stores

We then bitch about how the Government wastes our Tax Money; all the while we waste our own

I will go back to the start, Debt is NOT normal. We have only made it become the norm. It is not normal for 15% or more of your take-home pay to vanish into the pockets of lenders. It is not normal to pay 19.99% interest on any debt. It is not normal to be paying off student loans into your thirties unless you started late of course. It is not normal for each Canadian to hold on average 22K in consumer debt. These might be the stats and they might be the reality, but it is not normal. Don’t be the norm, be different.

I will get started next week/month/year (Laziness and Procrastination)

You won’t believe how many times I have heard someone say, “Well I’m not ready to get started yet, let’s talk next month.” While we all work on our own schedule, there is a problem with this mentality. Next month never seems to come. The day I decided to stop making excuses and fly right, everything changed. One thing most people don’t realize, going back to the first point, is that life doesn’t change that much in the positive category ever, money wise. That sounds really depressing so let me clarify.

Think of all the positive money events that have happened to you:

How many times have you gotten a raise?

How many times have you gotten a better job that pays more?

How many times have you fallen into money? (lottery, inheritance, huge tax return, etc.)

Now think about this:

How many times have you gotten sick or hurt?

How many times has your car broke down, or something in your home went on the fritz?

How many times have your kids cost you money?

How many times have you had to change jobs? (quit, fired, laid off, etc.)

How many times has something cost you money unexpectedly, that caught you off guard?

My point is this; there are endless amounts of excuses. I have maybe had five of the good money things happen to me in my lifetime. I can’t even count how many times something has happened that hit my pocketbook. So the count is 5 good things versus unknown/infinite bad things. You will be able to come up with something every single month of your life that will make you procrastinate getting your life in order. This is why I am always proud of every single person that contacts me to get started. It means that they realize something isn’t right, and they want to address the problem. Shit happening is just that, shit. Either you live in it and play in it, or you step outside it, and wash it off.

Guys like Tony Robbins and Dave Ramsey are influential for a reason. The words they speak make sense, and we all know them to be true. The problem is that what they say, and what we believe, isn’t always what we do. As I wrote this a sponsored Tony Robbins FaceBook ad came up, how ironic. The Ad says,

“Stop procrastinating and start achieving more with a Tony Robbins Results Coach. With a dedicated one-on-one coach in your life, learn tools to get out of your head and get on the path towards success.”

The guy is awesome! There is one fatal flaw that Tony seems to have picked up on. There is an endless supply of people who need his coaching. That is because there is an endless supply of people who know what they should be doing, and aren’t doing it. The 3 areas I mentioned, however, are finite, there is no endless supply. You will stop making money one day. You will get cut off from borrowing one day. You will run out of time to make excuses. What will happen then?

“He that is good for making excuses is seldom good for anything else.” – Benjamin Franklin

Email – joe@budgetboss.ca

Follow Budget Boss on – Facebook LinkedIn Twitter Instagram Pinterest Quora