Monday, November 20, 2017

Taking Stock: Market 101

Have you ever watched Business News Network or CNN Money during the day? It can get somewhat confusing when they go off on market capitalization, initial public offerings, options, PE Ratios, and every other term that the average person has no clue about. When you are an everyday person with your money in the markets trying to achieve growth, the inner workings of Bay Street aren’t that important to you. This week at Budget Boss will be aimed at demystifying the Markets and getting back to what is important to the average investor. Much like you, I am not a day trader or a stockbroker. I have a job and I invest for long-term growth. I value my savings and don’t want to lose them on the next fad that rolls through Wall Street. In this post, I will explain the major stock markets that matter to you in your everyday investing life and show their relevance. There won’t be any hot tips or insider information, just straight education on what matters most.

What is a Stock Exchange?

Simply put, an exchange is an institution, organization, or association which hosts a market where stocks, bonds, options, futures, and commodities are traded. Buyers and sellers come together to trade during specific hours on business days. Exchanges impose rules and regulations on the firms and brokers that are involved with them. If a particular company is traded on an exchange, it is referred to as “listed”. Companies that aren’t listed on the exchanges are called, “Over-The-Counter.” OTC companies are usually smaller and somewhat riskier as they do not or have not attempted to meet the criteria to be listed on an exchange.

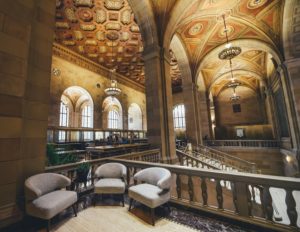

Even more simply put, a stock exchange is where people get together to buy and sell pieces of companies that they own called shares. They also buy and sell other investment products like bonds and commodities there as well. More and more the “physical buildings” on Wall Street and Bay Street are becoming just symbols, as the trading is being done online. The markets have become a figurative place where trading is done instead of an actual place where it must occur.

The Toronto Stock Exchange (TSX)

Oh, Canada! Here in our beautiful country, we have the 9th largest stock exchange in the world based on market capitalization, a term used by the investment community to rank the size of companies or exchanges. The TSX was founded in 1861 and it houses a broad range of companies from Canada and abroad. One claim to fame is that the TSX is home to more mining, oil, and gas companies than any other exchange in the world. That shows how heavy resources play a role in our economy.

The building located on Bay Street in Toronto has trading hours at 9:30 AM until 4 PM every day except weekends and holidays. There are over 1500 companies listed on the exchange from various sectors including financials, retail, resources, and technology. In Canada, all of our major banks are located near the top of the exchange as well as our national railway CN, and General Motors Company, GM. This year has seen the TSX cross record highs including crossing 16,000 for the first time.

Companies Listed on the Toronto Stock Exchange – The Upside

Why should you care?

Overall, when you are living in Canada you more than likely will be invested in Canadian stocks. The reason this is important is that the TSX has been a model of consistency for many years. In the investment world, people see Canada as a slow and steady grower. Not too much razzle-dazzle but at the same time not too much negative growth either. I look at the Canadian Markets like a train. It picks up speed slow and steady and has strength and stability. Those are all quality features in any market.

The New York Stock Exchange (NYSE)

The worlds largest stock exchange was founded in 1817 and is located on Wall Street in New York City. It houses several large indexes including the Dow Jones Industrial Average, the S & P 500 and the NYSE Composite. There are over 2400 listings on the NYSE and they have a market capitalization of over 19 Trillion dollars. Like the TSX, the NYSE trades at 9:30 AM until 4 PM excluding weekends and holidays. Also like the TSX, much of the trading is taking place offsite with the market having gone virtual.

The Dow Jones Industrial Average (DJIA)

The Dow Jones was founded in 1885 and is comprised of 30 of the largest companies in America. While the name industrial has stuck, the companies involved have very little to do with heavy industry anymore. They include a wide range of areas such as banking, fast food, oil and gas, telecommunications and retail. Some heavy hitters on the Dow include Apple, Microsoft, Wal-Mart, and 3M. The Dow is often seen as the indicator of how the stock market is doing overall. This year has seen the Dow reach records highs including passing 23,000 for the first time in its history.

Companies Listed on the Dow Jones Industrial Average – CNN Money

Standard & Poors 500 (S & P 500)

The 500 is a market index based on market capitalizations of 500 large companies located on several indexes including the Dow and the NASDAQ. It encompasses many different sectors including industrials, technology, agriculture, banking, and entertainment. Some notable companies include Google, Facebook, Amazon, Goldman Sachs, Home Depot and Coca-Cola. It differs from other indexes like the Dow and the NASDAQ because of its sheer number of companies across many sectors. It is often utilized as the most proper representation of the US economy because of this.

Companies Listed on the S & P 500 – CNN Money

Why should we care about American Markets?

The US is Canada’s largest trading partner and will be for the foreseeable future. It is often closely linked to us and our growth. If there is a downturn in the US, they, in turn, invest less in Canadian companies. Recently, protectionist politics have seen a “Buy America” voice emerge which might make Canadian products less appealing. For us, America has been a great source of growth in our own investing. In my opinion, everyone should have at least a small piece of the American Markets in their portfolio.

Overseas Markets

Some popular overseas markets include the DAX in Germany, the CAC in France, the FTSE in Great Britain, the Hang Seng in Hong Kong, the Nikkei in Japan, and the Shanghai Composite in China. Exposure to these markets is a bit more complicated as knowing the products and services used around the world can be confusing. Needless to say, it is a good idea to have at least a bit of exposure to overseas markets as the growth potential can be very large. We must remember that many of these countries are on the same economic level as the Western World was 50 years ago. This means that many of them have huge potential for growth in the future. It also means that they may be far more volatile in upcoming years as leaders in their markets emerge and pretenders fall by the wayside.

The secret to investing in the stock market is to have a well-diversified approached. Having all your eggs in one basket, (one country, one industry, one company), is never good. If you own pieces of several markets, you have a better chance of weathering any economic/political storms that may occur. Having a basic understanding of the market will allow you to achieve this with decent results.

Thanks for tuning into today as we begin market here at Budget Boss. Join us tomorrow as well delve into the Fixed Income Market and learn a little bit about what that means to you. If you have more questions about stocks or markets, please feel free to message me at joe@budgetboss.ca. Have a great week!

“One of the very nice things about investing in the stock market is that you learn about all different aspects of the economy. It’s your window into a very large world.” – Ron Chernow

Email – joe@budgetboss.ca

Follow Budget Boss on – Facebook LinkedIn Twitter Instagram Pinterest Quora